I’ve been wanting to test this Stock Yield Enhancement Program for the past 2-3 years, but each time I had a higher priority topic timing wise.

Anyway. Excuses, always excuses ;)

What is this stock yield enhancement program?

Basically, this Interactive Brokers program is an option you can activate to increase the return on the securities you own.

The concept is simpler than it seems:

- You own shares

- You allow IBKR to lend them to other traders who are willing to pay interest for them (see the box below to understand why someone would do that)

- IBKR pays you 50% of the interest they earn

Isn’t it risky to do that? Where is the catch?

Indeed, it seems almost too good to be true to be able to increase your yield with a click.

Like you, I tried to understand the risks behind this program (IBKR is really transparent and explains them in detail).

The first risk is that the borrower of your share does not return it for whatever reason.

And it should be noted that the SIPC (Securities Investor Protection Corporation, an institution that guarantees, among other things, the stock portfolio of each investor via an American broker up to 500k USD) does not guarantee the potential losses related to these stock loans via the IBKR program.

This risk is therefore very real.

And the SEC (U.S. Securities and Exchange Commission) requires Interactive Brokers to have a plan B if a borrower can’t give you back the shares you loaned them.

This Interactive Brokers Plan B is simple: each loan of X amount of stock is matched by the same amount in cash or U.S. government bonds by Interactive Brokers.

This means that if you lend CHF 100 through this program, Interactive Brokers must have CHF 100 in cash or US bonds in case the borrower doesn’t pay it back, so that you are guaranteed to get your money back.

So you can sleep on your two ears!

Except, there is another risk that comes with it…: that Interactive Brokers goes bankrupt.

And therefore no longer be able to pay you back for those shares that you have lent and not been paid back.

And it is this risk that is very real.

The way to mitigate this risk is to analyze IBKR’s financial health and its risk of bankruptcy.

Interactive Brokers Financial Health

I am not a due diligence specialist, but here are the reasons that give me confidence in IBKR (and not only for this yield enhancement program):

- IBKR has US$7.7 billion more than regulatory requirements

- 75.5% of the Interactive Brokers group is owned by its employees. That’s huge! And it proves that the motivations for the company’s success are linked to people inside the company, not outside. And that, I buy!

- Thomas Peterffy, the founder of Interactive Brokers, is still the chairman of the board AND is still the largest shareholder in Interactive Brokers. So he has a vested interest in keeping his company running to preserve his fortune. This kind of “skin in the game” is as important as any profit and loss report in my eyes

Based on these facts, as well as the reputation of IBKR built tirelessly since 1977 (!!!), I decided to trust them (once more).

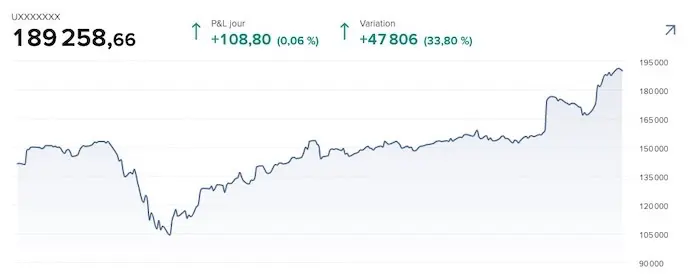

So I’m going to test their stock yield enhancement program with my own 300k+ CHF invested in the stock market.

Good question! It' s the traders who believe they can predict the market who engage in this type of practice, also known as "short trading". Basically, a "short" position consists of borrowing shares from a stock lending service [NDLR: the one we are talking about in this article]; in return, the trader pays a borrowing rate for the duration of the short position.

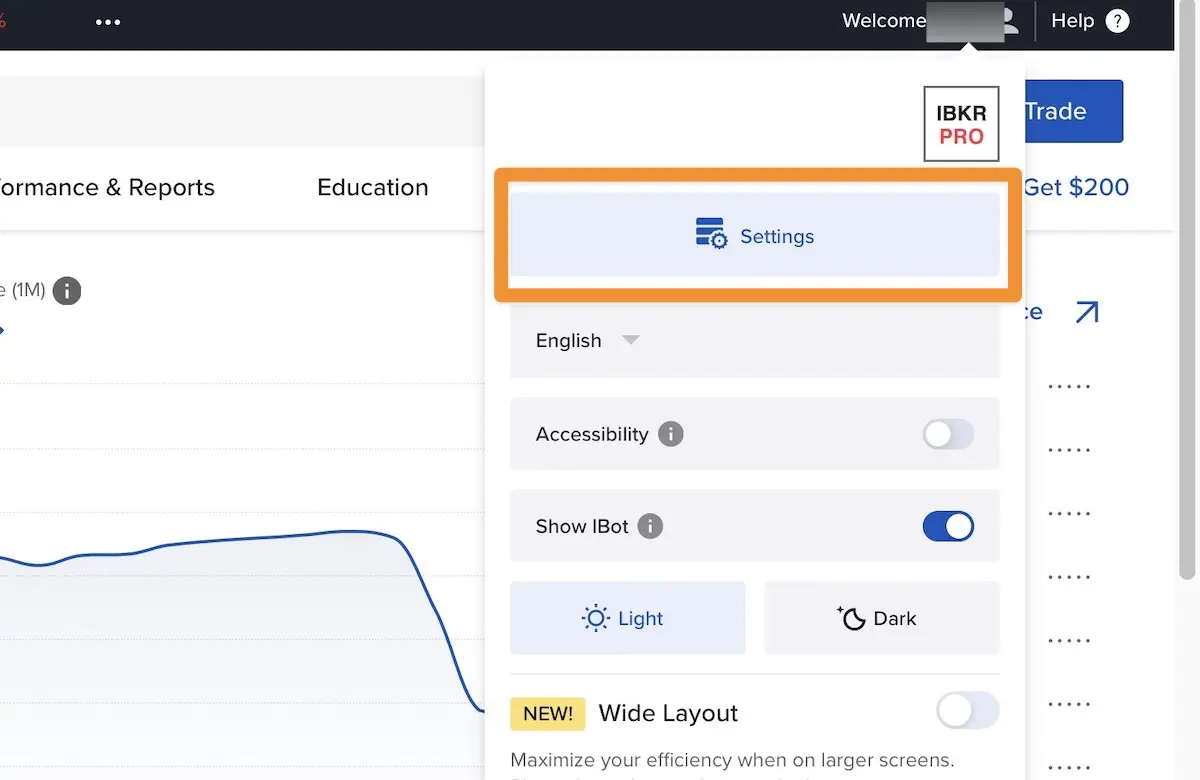

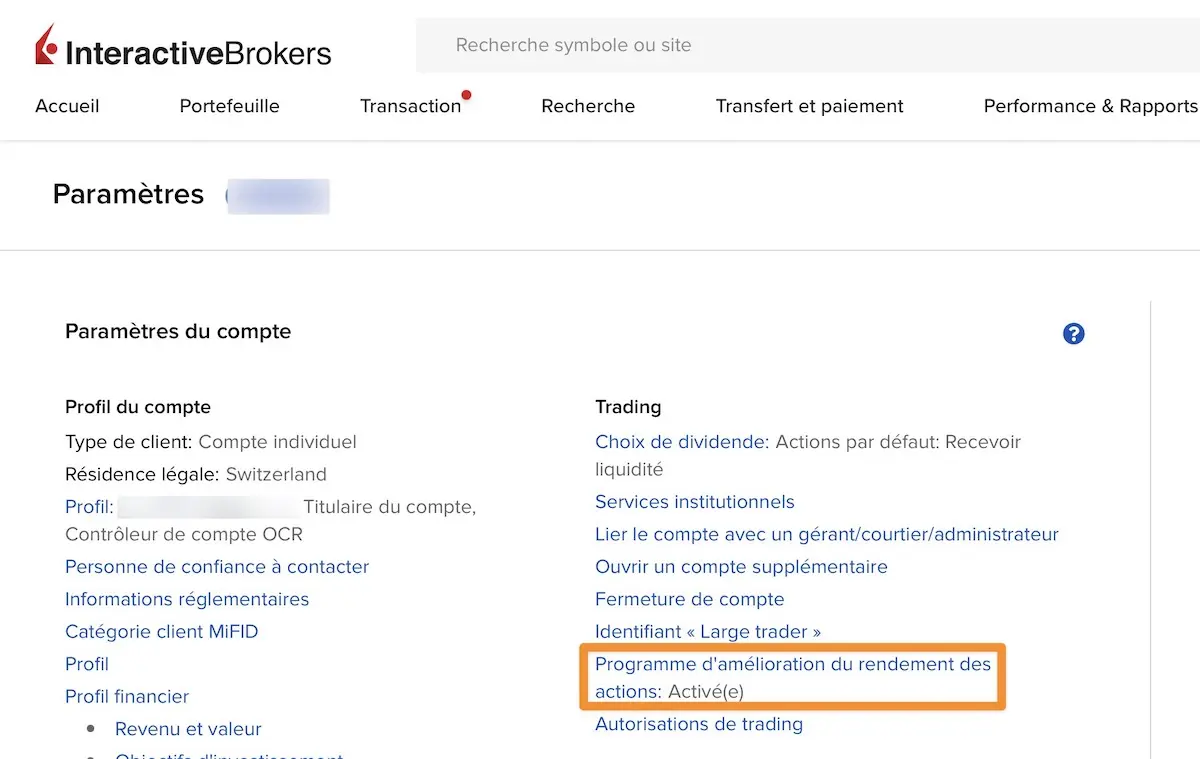

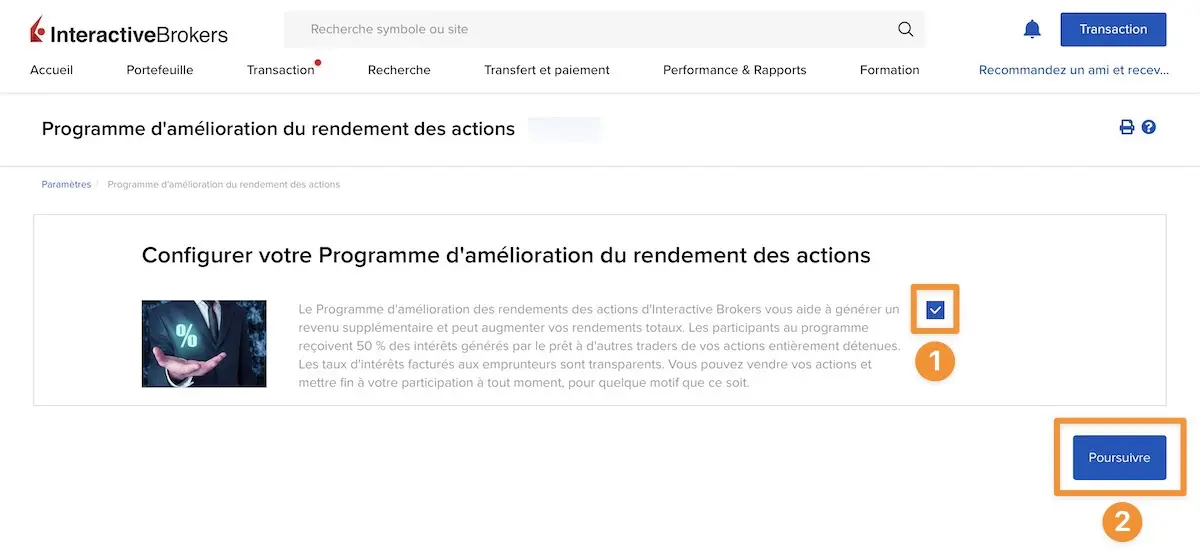

How to activate the Interactive Brokers Stock Yield Enhancement Program

I found the activation really easy compared to other actions in the Interactive Brokers user interface.

You just need to go into your account settings, click on " Stock Yield Enhancement Program", then enable the feature by checking the box, and submit the form. That’s it!

In pictures, it looks like this:

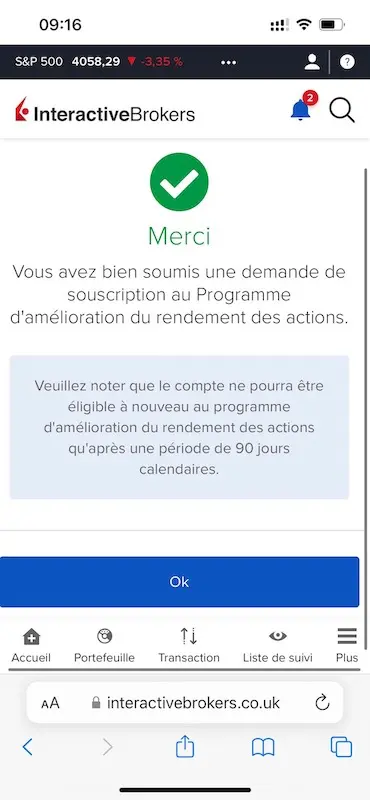

Then you wait patiently for a few days (only one in my case), and you get an email like this when the program is activated for your account:

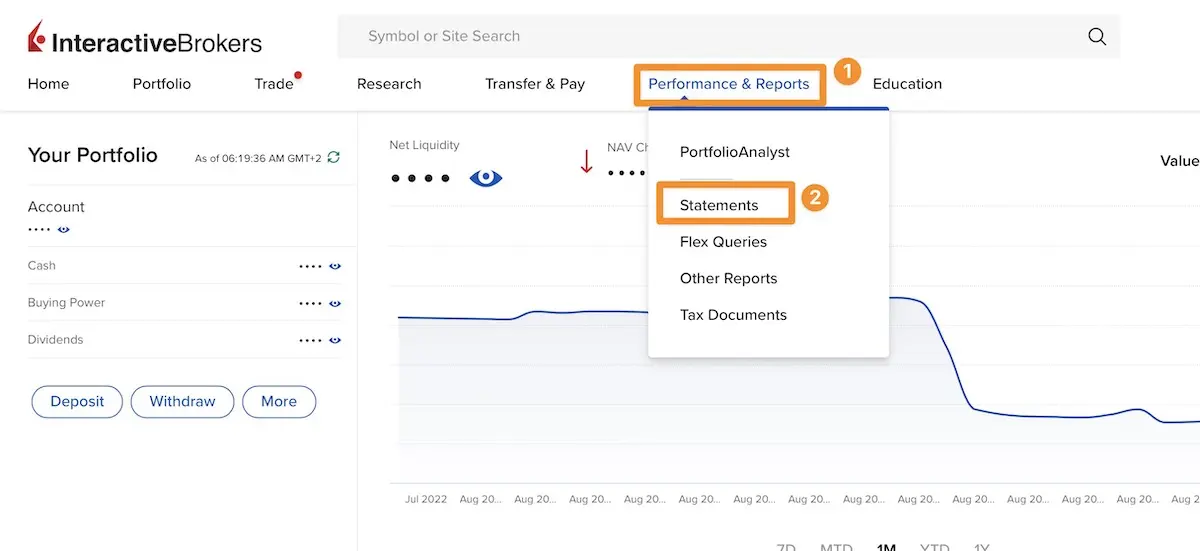

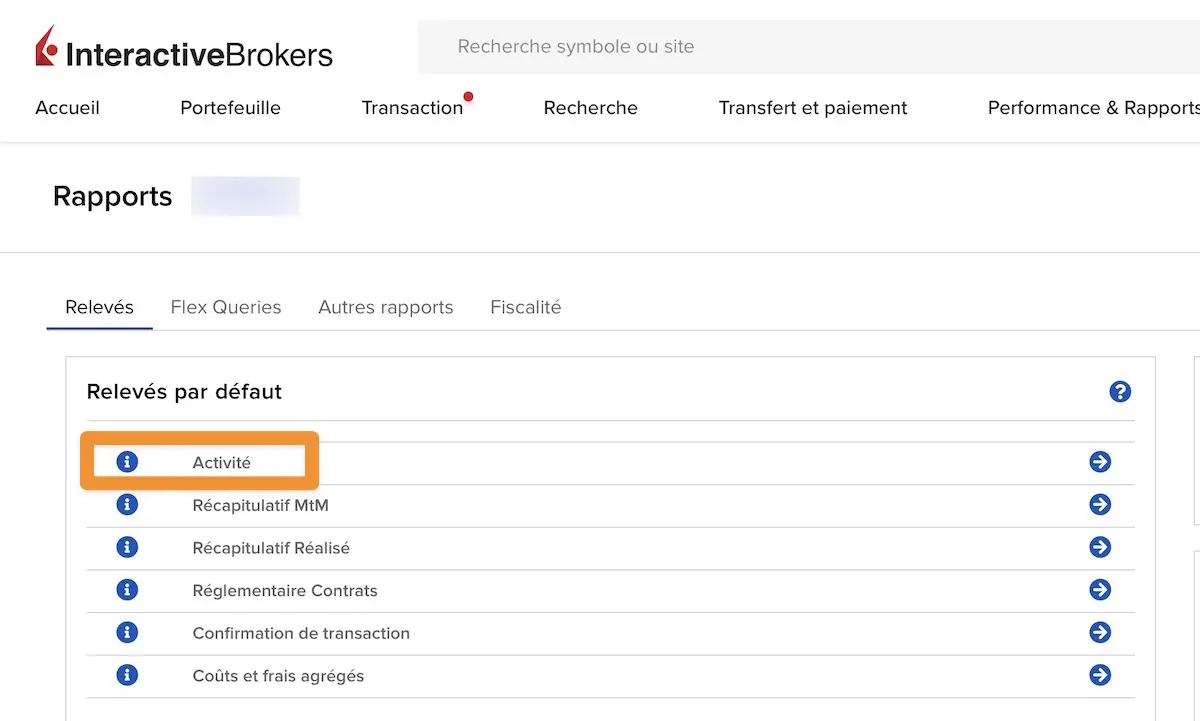

After that, you can check the next day to make sure everything is running smoothly by checking your activity records. You can’t do this the same day because the activity record is only available for the previous day at the earliest.

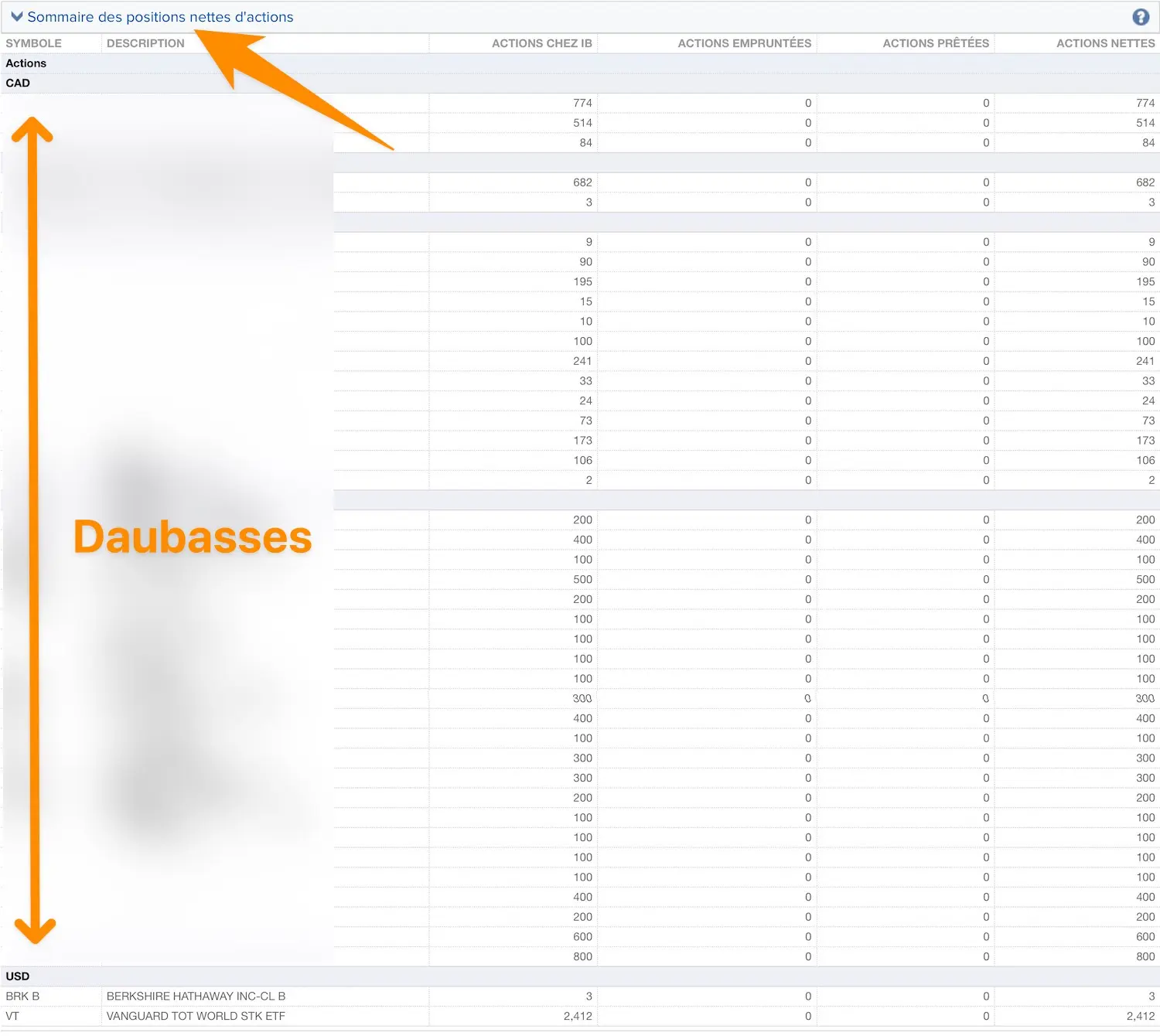

As you can see in the screenshot below, the SYEP program has been activated, and we can see that for the moment none of my shares or ETFs have been lent:

You can see the new section 'Net Stock Position Summary' which confirms that the program is activated

Here you go, your Interactive Brokers account is ready to receive its first interest from the Stock Yield Enhancement Program :)

Note on dividends and withholding taxes

It’s important to understand that when you lend an ETF or stock through this IBKR stock yield enhancement program, the stock is in someone else’s hands.

And so, when the day of the dividend payment comes, it is the one who owns the stock on that day who will receive the dividend.

No worries though, because if this happens to you, IBKR pays you this amount via a “Payment in Lieu” which simply means that it makes you a credit note. So you don’t lose the dividend.

However, the devil is in the details.

Because via a “Payment in Lieu”, IBKR does not handle any claim for recovery of the withholding tax… that money is lost to you forever.

BUT, because there is a BUT.

IBKR has planned for just that, and the shares that are loaned are usually called back to the borrower before the expiration date in order to capture the dividend and avoid payment in lieu of dividends. But sometimes you get a PIL, and lose the option to claim the withholding tax.

Anyway, for my part, I decided to try it out to see how it works in practice and to make up my own mind whether I will continue with this program or not.

Conclusion

I will now wait patiently for a few months to see how it turns out.

And no later than a year from now, I’ll debrief you on whether it’s worth it, and whether or not I continue to participate in this Interactive Brokers Stock Yield Enhancement Program.

UPDATE 03.11.2023: and here is what I think about this SYEP program by IBKR one year later >

And you, have you ever tested this Interactive Brokers program? If so, how did it work out?