July saw our stock market investments continue to grow. And our expenses remained in the normal range. All of which allowed us to reach a savings rate above 50% once again. It feels good!

If you are new to the blog, I recommend reading the article that introduced this series about my net worth (including my lucky number, as well as the rules of the game).

Also, following questions from some readers, I would like to point out that the green or red figures below correspond to the relative evolution compared to the previous month, and not to the absolute amounts of the current month.

July: Remote work means less transportation costs, mortgage interest, hairdresser for Mrs. MP, and various summer gifts

CASH FLOW AND SAVINGS (+CHF 15'045.13): We continued to do a fair amount of remote work in July with Mrs. MP because of the coronavirus. This allowed us to reduce our transportation costs. On the other hand, due to vacations and visits to friends/family, we spent more than usual in the “Gifts” category — with great pleasure when it is precisely to please others.

As usual, let’s take a look at our unusual expenses first:

- Restaurants: as often during our vacations, we’re letting it go on this item. CHF 615 to be precise… I realize that I’m more relaxed to spend on such outings, because we have a good time with family and friends. But this “more relaxed” side could also be a consequence of the “inflation of the standard of living” that accompanies our recent salary increases, as well as income related to my personal projects. I’m giving myself a yellow card here, to pay more attention to this point in the coming months. One excuse that may partially explain this increase is our children: as they get older, they take less and less children’s menus, and more and more often the same thing as ourselves…

- Mortgage interests: every semester, we receive our invoice for the mortgage interests of our apartment for an amount of around CHF 4'670

- Transportation: With the vacations, we had about three extra fill-ups of gasoline compared to normal. This is equivalent to about CHF 180 with our frugal Prius

- Medical (doctors and pharmacy): finally a month without big orthodontic or pediatrician bills! Just a few (too many!) visits to the pharmacy for a total of about CHF 100

- Hairdresser Mrs. MP: CHF 115, and I hear it’s not that expensive because it’s just a cut + brush… so I consider myself lucky :D

- Clothes Mr. MP: As I often brag about it on the blog, I spend almost nothing in this category because I keep them for a long time. But then I had to replace three old shorts that were starting to fall apart. Total CHF thanks to sales: CHF 91.25. Not so bad.

- Gifts (including birthdays): summer often involves visits to friends and family, which increases our gift budget. Coupled with this, we generally take advantage of this time of the year to group together several anniversaries (planned in YNAB, I reassure you), which brought us this year to a total amount of CHF 828… Ouch!

Nice summer walk in Estavayer-le-Lac (including a very good home-made ice cream, without any guilt!)

Concerning unusual cash inflows (i.e. outside of our salaries):

- I received an unexpected bonus (but always nice!) at my job

- My Swiss shares paid me a nice dividend

- Same for some Daubasses “value investing” shares which paid me some dividends

- We finally received an expected reimbursement (thank you orthodontics…) of more than CHF 800 from our complementary health insurance

- Regarding our rental property in France, we had a new tenant coming in, with the three-month deposit that goes with it (but which, if all goes well, which we hope will be the case, we’ll have to give back when he leaves)

- Big money coming in (but big disappointment too): like many Swiss people, a nice trip planned for almost two years has been cancelled because of COVID-19. Luckily, we have been reimbursed in full

- Finally, many of you have again used my recommendations to save as much as possible on your Swiss bank fees (more than CHF 300/year very often) as well as on your brokerage fees as a Swiss investor. And I’m not talking about the “Kickstarter” support of my book project which I appreciate even more (book which, by the way, is coming out in mid-November!) Thanks again to you for supporting the blog using my affiliate links. It’s really nice to see it take off in terms of revenue, while bringing you value as you explain to me in your emails

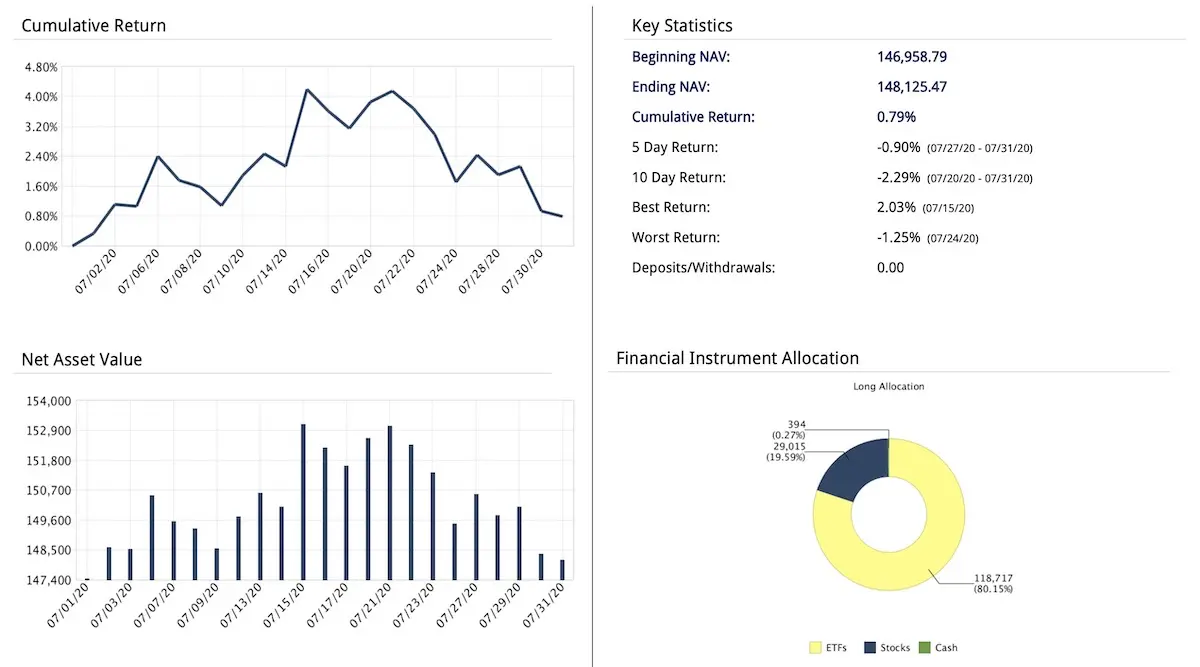

STOCK MARKET INVESTMENTS (+CHF 2'758.48): All the lights were green in July. Both my Swiss shares and my international shares all saw their value increase between the beginning and the end of July.

I also bought 3x of VWRL via the DEGIRO brokerage account of the children (like every 2-3 months).

And I continued my value investments (via the Daubasses) by buying CHF 400 of a share at a discount on the… Japanese market again!

What’s more, I realized for the first time in my career as a value investor not one, but two capital gains. As you know, I am currently learning by following the very detailed explanations (as well as their purchases/sales) of the Daubasses 1. Their process is transparent and understandable, which made me choose them compared to other paid newsletters too “bullshit marketing”.

I redid the annualized return calculations of these two sales to be sure, and this is what it looks like (you already knew beforehand if you are a blog sponsor):

- 1st Daubasses share: I bought it at the very beginning of April 2020, and resold it during the third week of July for an indecent annualized return of 509.54%!

- 2nd Daubasses share: bought early April 2020 as well, and resold the same third week of July for an annualized return of 546.92%!

Be careful though: don’t rush on their newsletter after reading these two incredible performances. Indeed, you will note that the period of the coronavirus crisis was rather favorable to make sales. And it will not (well, I don’t know but I hope not) happen again so soon. So only go for it if you understand (really!) what you’re doing, and don’t follow what some guy on the world wide web is telling you.

P2P INVESTMENTS (-CHF 50.31): No surprises on the Mintos side. I’ve stopped all investment, and I’m gradually getting my cash out. It’s not that I wouldn’t want to go faster, but the Mintos “Invest & Access” program doesn’t allow me to. Once the account is completely emptied, I will close it definitively and do a post-mortem article to explain in detail my motivations for not continuing in P2P investments.

CRYPTOCURRENCIES SPECULATION (-CHF 14.67): Once it goes up, once it comes down. As unpredictable as we thought. The day I’m at +1 million CHF, I’ll sell. In a century maybe…

MP’S 2ND PILLAR (+CHF 602.85): Filling my second pillar as usual.

MRS.’ MP 2ND PILLAR (+CHF 352.20): Filling Mrs. MP’s second pillar as usual.

MP’S 3RD PILLAR (n/a): Nothing to report because I make my lump sum payment at the beginning of the year (only Mrs MP is lucky enough to be at VIAC… my 3rd pillar being one of the guarantees for our mortgage), and my updated surrender value also comes at the beginning of the year.

MRS’ MP 3RD PILLAR (+CHF 2'488.60): As Mrs. MP’s Pillar 3a is invested via VIAC at 100% in global equities, the stock market performance also affected it with a nice capital increase for July (i.e. CHF 1'924.60 capital gain, the remaining CHF 564 being the one paid monthly into the 3rd pillar account).

If ever, VIAC recently announced an increase of its free management bonus up to CHF 5'000.

Therefore, I have a last invitation code “gCnmpVV” which will allow you to have free management on the first CHF 500 saved on your pension account (valid for life!) — leave a comment below if you use it, so that I know who to thank ;)

APARTMENT AND MORTGAGE IN SWITZERLAND (n/a): Nothing to report, we still do not repay anything as mortgage rates are so low, and we have not made a revaluation of our property so we do not speculate with its value (i.e. we keep the amount of our initial 20% down payment that we had to pay when we bought our home).

REAL ESTATE INVESTMENT IN SWITZERLAND (n/a): As a reminder, the 30kCHF invested here is a participation in a Swiss real estate project (i.e. not in my own name). I am still considering getting 55% of annualized return.

RENTAL BUILDING IN FRANCE (n/a): Same as for our apartment in Switzerland, no speculation on the price of our rental property. We will wait until we want to sell it to make an evaluation.

MORTGAGE LOAN IN FRANCE (+CHF 719.10): The magic of real estate investment: the loan repays itself “on its own” thanks to the rents.

SCI (SOCIÉTÉ CIVILE IMMOBILIÈRE, REAL ESTATE INVESTMENT COMPANY IN ENGLISH) IN FRANCE (+CHF 451.40): Cash flow continues to be positive pending taxes.

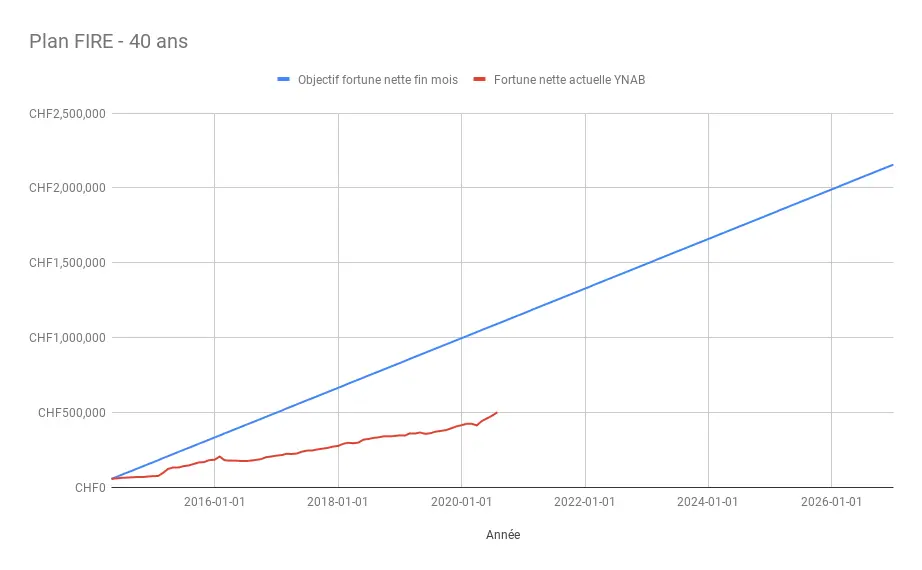

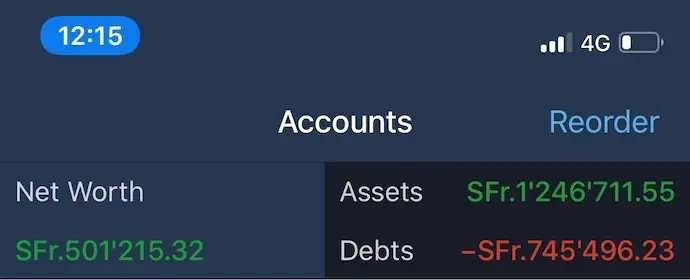

In terms of financial independence, we are at 23% of our objective of CHF 2'156'000 with our net worth of CHF 502'531.65.

Which visually gives us this:

Savings rate for July

In the end, we finished with a savings rate of 57% for July 2020. We continue to move towards a very good vintage for 2020. But we remain focused because the second half of the year has just begun, and we still have half a year to continue optimizing our revenues and expenses to widen the gap between the two as much as possible.

And you, what was your net worth and savings rate in July?

PS 1: if you also want to have access to bonuses such as the screenshot revealing the amount of each of my assets (I post it every month when this net worth update’s article is published online), then you just have to become a patron of the blog via Patreon.

PS 2: I’ve added a new “bonus” for the blog’s patrons. Since last month, I publish a live notification of my buy/sell on the stock market and other investments (translated into three languages like the blog — i.e. EN, DE, and FR). Just to be clear, I follow a rather passive investment methodology with ETFs disclosed on my blog, so you won’t learn anything transcendental. But if it can motivate you to invest regularly and in a disciplined way, then I will have succeeded in my wager.

PS 3: as a patron or future patron of the blog, don’t hesitate to let me know what other bonuses you’d like to have.

PS 4: I’d like to take this opportunity to thank the five new patrons of the blog Pranav, Amaury, David, Sam and Kevin. A big thank you for your support!

The further I go, the more I feel that I have more control over my investments with the Daubasses than with my ETF investments. Indeed, thanks to the former, I understand exactly why and how to buy undervalued shares, which mathematically can only go up. And this is compared to following a world index with my ETFs where I am certainly more diversified (several thousand companies vs. 30 with the Daubasses), but where I have the impression of having no control.

That’s what’s going on in my mind at the moment.

But until further notice, I’m limiting myself to my 30kCHF of Daubasses (plus or minus a few reinforcements or resales) because Buffett himself indicates that for the lambda investor that I am, the best way to make a portfolio worthy of the name grow is to invest in a low-cost international ETF. And in view of the hindsight he has (several decades) compared to the Daubasses (a decade), I will remain cautious for now. ↩︎

Net worth and savings rate update August 2020 CHF …

We're half-a-millionaire! 🎉 (CHF 501'215.32 to be...