You all know how much I respect and admire Interactive Brokers.

And especially its founder, Thomas Peterffy.

A true textbook case of a “bootstrapped company” as they say.

No external investors such as funds or VCs (Venture Capital). Nada!

Above all, since Interactive Brokers was founded in 1978, Thomas Peterffy never sold it.

Over the past few decades, I’m sure many US brokers would have liked to acquire IBKR…

But no!

I’d always wanted to talk to this Thomas Peterffy, to see who was behind the official photo on the IBKR website.

So imagine how happy I am as I write this…!

Because yes, I was lucky enough to be able to interview the founder of Interactive Brokers :D

I was like a kid at Christmas (except that it was the end of July).

MP’s exclusive video interview with Thomas Peterffy

Here is the interview with the founder and president of Interactive Brokers:

Video transcript

And if you’d rather read than watch the video, then here’s the transcript of my interview with Mr. Peterffy.

1. What ties did you keep with Europe?

I was born and raised in Europe, in Budapest, and at age 21 I left to visit relatives who had a chalet in Luzern.

So that’s where I went, and I spent months there with them, experiencing for the first time life without socialism and without fear.

That was great.

And from there I went to München, where I spent four months waiting for my permit to enter America, and then I left from there to go to America.

In America it took me a long time to feel at home, especially since at the beginning I didn’t have any money and I lived in even worse circumstances than I lived back in Hungary.

Nowadays, when I go to Europe, I always have to admit to myself that I feel at home in America more than I feel in Europe.

2. Are you more Zürich Paradenplatz or Geneva water jet?

I am more Paradenplatz.

I prefer to stand on solid ground… solid dry land.

3. What are one to three books that have greatly influenced your life?

Growing up in socialist Hungary there was censorship, but I was very lucky because my grandmother had a good library with all the classics that were written well before the Second World War and she acquired them before the Second World War.

So I learned about free enterprise from Dickens and Thackeray and Gut and Balzak and Turugo and Stendal and Zola and many Hungarians who you don’t know. In retrospect, they all flow together in my mind now.

They flow together into a composite picture of the human condition and a picture that I found true in life.

The constant need for food and sex and social position, how people relate to work and money and business, ambition, drive, faith and morality they are all described and very well explained in those books.

And those books help me to navigate through life.

4. If you could put up a gigantic billboard in the middle of Zurich Paradeplatz, what would it say?

I would say do what you can today, don’t wait for tomorrow.

Do what you can do today and don’t wait for tomorrow!

5. Once you crossed the 1M USD of net worth, why didn’t you sell IBKR and retire from ever working again?

So building IBKR has been a fantastic lifelong adventure for me.

I enjoy almost every minute.

It is a great pleasure for me to be able to set goals, identify and solve problems, and to see the company grow and prosper.

As a result, I cannot imagine anything else I would rather do or find more interesting or satisfying than to continue this as long as I can.

Now, when you have money… money changes its character in the eyes of an entrepreneur as the business grows.

At the start, the enterprise takes personal money, so it focuses keen attention on revenues and expenses.

They dominate the mission.

As the business matures, revenues and expenses become part of the mission.

And entrepreneurs do not think much about money in a personal sense. It’s all about the mission.

6. Here in Switzerland, we fear losing access to our beloved VT ETF… Will IBKR fight for us to keep it available?

We’ll certainly try to give our customers what they want.

I think the regulation you are talking about applies only to some specific US ETFs.

Regulators often look at products and practices with different glasses.

We’ll certainly try to give our customers what they want.

They often want to protect the uninformed impulsive investors at the expense of the well-informed.

They are willing to spend $10 or even $100 to eliminate $1 of harm.

Unfortunately, by doing that they throw sand in the gears of the economy.

They can’t help it.

They are regulated…

7. What do you fear the most that could disrupt your business model (like the iPhone and BlackBerry story)?

I don’t think anything will as long as we are diligent and constantly think about how to take advantage of future technologies and developments to broaden our services and to become better and more cost-effective in providing them.

That’s what it’s all about.

8. What’s the one thing still releasing intrinsic fulfillment and dopamine to your brain nowadays?

So I start every day with my reports from the previous day.

Seeing more customers coming to the platform, seeing greater usage of tools and accommodations we provide rising customer profits, all fill me with excitement.

Trying to discern what new products or tools or facilities would benefit their experience or customers’ experience on the platform, trying to create them gives me a thrill.

9. As a multi-billionaire today, what’s the challenge you still have that you had when you were 30-40 years old?

I would still like to have more thrills :)

And I would still like to get more things done faster and better.

The fact is that I could never figure out how to do more things at the same time by just hiring more people and still remain excellent.

So that is the challenge: It is difficult to expand a successful business and not drive it into mediocrity.

10. Each time you had a big decision to make (that your brain couldn’t solve alone), what was your process to make it happen?

Writing clears the mind.

So I list all the possible choices and outcomes on a piece of paper.

Then I assign associated probabilities that I try to evaluate and the relative value of each outcome.

And then I multiply it through and the biggest number wins.

It’s all about evaluating probabilities.

Just like in business, trading, or investing.

Writing things down clarifies the mind.

11. Who was your mentor in your ascending years (1977-2000)? Why?

I didn’t have a mentor.

I was always sure of what I wanted to do, even when in retrospect I shouldn’t have been.

Luckily I entered into a business that sorely needed automation and I just happened to have the necessary skills and ambition to do it.

I did have some wonderful people helping me along the way.

All of them still work with me today.

It is true that I’m eleven years older than my oldest associate.

But at IBKR we have fun working.

Nobody retires.

We look at what we are building and we are all proud.

12. Imagine my 10-15-year-old daughter next to me now and asks you boldly: “Hey, Mr Peterffy, nice to meet you! I would like to invest to make my money grow, but… honestly… it’s boring! What strategy would you recommend me to follow for the next 20 to 40 years?”

I would do everything I could to try to convince her how fascinating the investment world is and why it is worthwhile to learn about it.

I would try to explain to her and illustrate with examples that in a free market economy, just like kids in school, we all compete with each other about who is cool.

We often organize into groups to produce goods and services and that is good because it provides for our needs, right?

We produce things like iPhones, computer screens and electrical bikes and movies.

I would show her how all these things compete for her attention and choice as a user.

So the companies and the groups of people with the best products and best prices grow and the others go out of business.

It’s a race, it is a competition, it is fun, it is cool and profitable to be able to pick the winners.

And it’s good because as consumers we get better.

So I would find similar products she uses or picks from the store and show her choices. Via her choices, she participates in the economy as a judge in the competition with her purchases, she selects the winners.

As an investor, she tries to handicap the winners by buying the risk, pushing up the price of the stock, and giving the company her investment as a vote of approval that the company can use to expand and produce more and better products.

The companies with the best products will win and she is among the people who make that happen.

That is really cool.

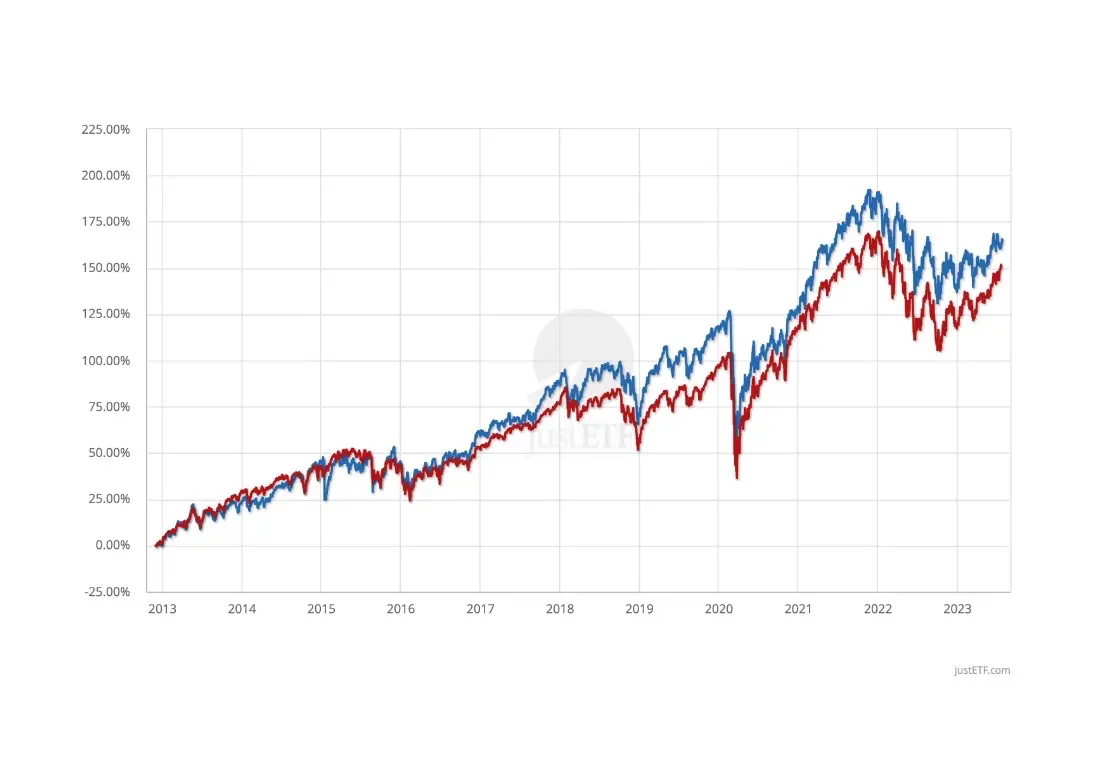

In the end, I would tell her how cool it would be if she learned about investing, but until she does she should just buy the Vanguard VT ETF..

BUT, until she gets interested in how the investment world works, she should simply buy the Vanguard VT ETF.

13. What positive things do you think AI can bring to the world of investing/trading?

So if you think about research, in research we basically need to bring enormous data sets together analyze them, and distill them.

The human mind is not really capable of doing that.

Computers can do it.

So that’s what AI basically does brings a lot of data points together and figures out where they point.

So what I think is going to happen is that there’ll be more and more companies will enter into the business of using AI to predict the financial outcome of various companies and they will make that available to certain investment advisors who will then run their clients’ portfolios.

Based on that and what we are doing at Interactive Brokers we are readying ourselves to be able to offer that service to financial advisors and individual customers too.

And as a matter of fact, already at the moment we have one of these things that is called toggle, that is available to our customers. It continuously evaluates individual securities and tells you what in their view their AI, what it says about what the chances of any stock is to reach certain prices, etc…

14. What concrete actions did you take to ensure that IBKR will be there decades from today?

So basically, I keep all my money in the company, almost all my money.

So it’s important for me that the company does well not only from that point of view but also it’s my legacy.

So I want to make sure that we have plenty of people in line starting with people in their twenties all the way up to Milan, Milan Galik, current CEO of Interactive Brokers, who is in his mid-fifties and there is a deep bench of people to take over in the coming decades.

15. I’d be honored to share a fondue with you next time you visit Switzerland. Would you be in?

Here’s what we’re going to do: if I go to Switzerland soon, because I haven’t been there for a long time, but when I do, I’m going to our Zurich office, so I’ll take you out for a Kirchwaser fondue. :)

My thoughts from my interview with Thomas Peterffy

Don’t put off until tomorrow what you can do today

The proverb is well-known and may seem simplistic.

My mother told me often enough: don’t procrastinate, and do it now rather than say you’ll do it later!

But this time it resonated with me, as I’m currently reading the excellent book called “War of Art” by Steven Pressfield. In it, the author talks about that “Resistance” that anyone who creates anything (author, painter, musician, sportsman, etc.) must face… every morning. And the solution is first to be aware that this “Resistance” exists and then to simply start doing what you “must” do, without questioning or thinking about it.

And once started, as if by magic, the “Resistance” disappears.

This is what I regularly experience when faced with the task of starting a brand-new article…

And then, every time I get down to it, 5 minutes later I wonder why it seemed so hard…

As usual these days when I want to understand a concept in its entirety (and avoid my “blind spots”), I asked my ChatGPT coach to list the negative consequences of procrastination:

- Accumulation of work if you’re constantly putting off tasks, which can cause stress and anxiety

- Stress and guilt from knowing you have pending tasks

- Diminished quality because you no longer have time to do a task properly, because it’s done “at the last minute”.

- Unforeseen lack of time because of unexpected circumstances - e.g. I’m going to do the housework tomorrow (Sunday), and then your parents tell you they’re coming over unexpectedly (double punishment: you don’t have time to do it + guilt that your parents will see your apartment in a mess)

- Loss of efficiency because you lose the flow of concentration which takes you ages to “get back into it” when you dive back into the task several days or weeks later

In short, I agree with Thomas Peterffy: stop procrastinating and ask yourself if/what/how you should do that task your subconscious knows is important, and DO IT NOW!

Net worth is no longer the priority after a certain point

I found the part about net worth and your company’s mission very interesting.

For me, before I passed the one million Swiss francs net worth cap, I put a lot of focus on increasing our net worth.

But since a few months (or even a year or two) when the blog has gotten some traction and visibility, I’m beginning to understand what Mr. Peterffy means…

My mission to help each and every reader is taking over more and more because I know deep down that my FIRE “flywheel effect” has started and that I’m going to reach it.

As a result, my considerations increasingly revolve around my mission, and my why.

Interactive Brokers ETF VT, what is the current situation? :)

I took away two pieces of good news from this part of the interview:

- Thomas Peterffy’s focus is on his customers’ needs, not making his job easier as IBKR. He could have told me that “Switzerland is in Europe in his point of view, and that’s life”… but no, on the contrary, his aim is to “certainly try to provide our customers with what they want”!

- The founder of Interactive Brokers is as fed up as the rest of us with the regulations, which protect impulsive, ill-informed investors to the detriment of well-informed ones…

As long as this mindset is the cornerstone of IBKR, I can tell you I’ll be staying with them indefinitely :D

Maintaining their excellence

“It’s difficult to develop a successful business without leading it to mediocrity.”

Having seen it for myself in my own company and with some of my customers, I can only agree with Mr. Peterffy in his point of view.

If only more CEOs would follow this motto of maintaining excellence regardless of the level and size of their company, everyone would benefit, both employees and final customers.

Vanguard’s VT ETF, again and again!

I laughed out loud when the president of Interactive Brokers took a detour to explain investment trading to my daughter!

But what I didn’t expect was the conclusion:

*Until she gets interested in how the investment world works, she should simply buy the Vanguard VT ETF.

Even if someone who is so involved in finance thinks that this VT ETF is the perfect way to get the best of both worlds of yield and simplicity, then what I’m talking about isn’t bad at all :D

“Nobody retires at IBKR.”

We talked about the FIRE movement off-camera.

His response was blunt: “Sorry, I’m not familiar with this [FIRE movement]… and knowing that I’m never going to retire, I think you’re talking to the wrong person ^^”

On the one hand, I find it reassuring and cool that Thomas Pterffy has this mentality (as well as his employees including IBKR’s CEO), as it’s definitely going to benefit me/us as Interactive Brokers customers. Indeed, such a mindset won’t make them resell to a larger group who would then only seek to make their investment profitable in the short term to the detriment of end customers.

On the other hand, his statement “I will never retire” reminded me of the quote from Jean-Claude Biver (former CEO of the Hublot watch brand) when he announced the launch of a new brand at the age of 73:

You can’t retire your passion!

All this just confirms that what I want in the FIRE movement is just the first two letters: Financial Independence! Retirement as most people imagine it (beaches and cocktails 24/7), isn’t for me either!

How do I open an Interactive Brokers account?

If you are new to the blog, I’ve created a complete guide to Interactive Brokers.

It explains, among other things how to open an Interactive Brokers account, and how to buy your ETFs via the IBKR brokerage platform.

And you, what do you take away from this interview with the founder of Interactive Brokers?

Disclaimer: there are affiliate links present in this article. You can also find the same information by doing a simple Google Amazon search. As a reminder, I only recommend products I use myself in everyday life